do you need a business license for airbnb

You can find out more about the. That means that you need to ensure that rules.

Airbnb Free Smoke And Carbon Monoxide Alarm Airbnb Short Term Rental About Me Blog

Youll need to register your small business.

. In addition to safety requirements Airbnb rules also dictate that you should be mindful of your neighbors. Start an airbnb business by following these 10 steps. The Calgary City Council voted Monday to require Airbnb and other short.

Be a Good Neighbor. Do I need any type of business license or certificates to start hosting Airbnb in Montreal Queb. There are several licenses and permits you may need to start an Airbnb business depending on your location.

Get your pen and paper ready and tak. What License Do I Need For Airbnb. 4 Check Subletting is Permitted.

Youre also going to have to consider things like bed tax which is collected directly. Well research all your license requirements and provide you with the forms youll need. A business license tax certificate short-term rental.

Here we have to have a business license and a TOT Transient Occupancy Tax certificate and the town government actually employs someone to troll Airbnb VRBO etc. Youll need a business license to operate a business rental. The State also requires that you pay a general excise tax on all.

Using Airbnb means that you need to make sure your unit is furnished and clean for every renter you have. Types of Accommodations on Airbnb. We started renting last year and in our state we needed to have everything set up and on file including a business license before we could.

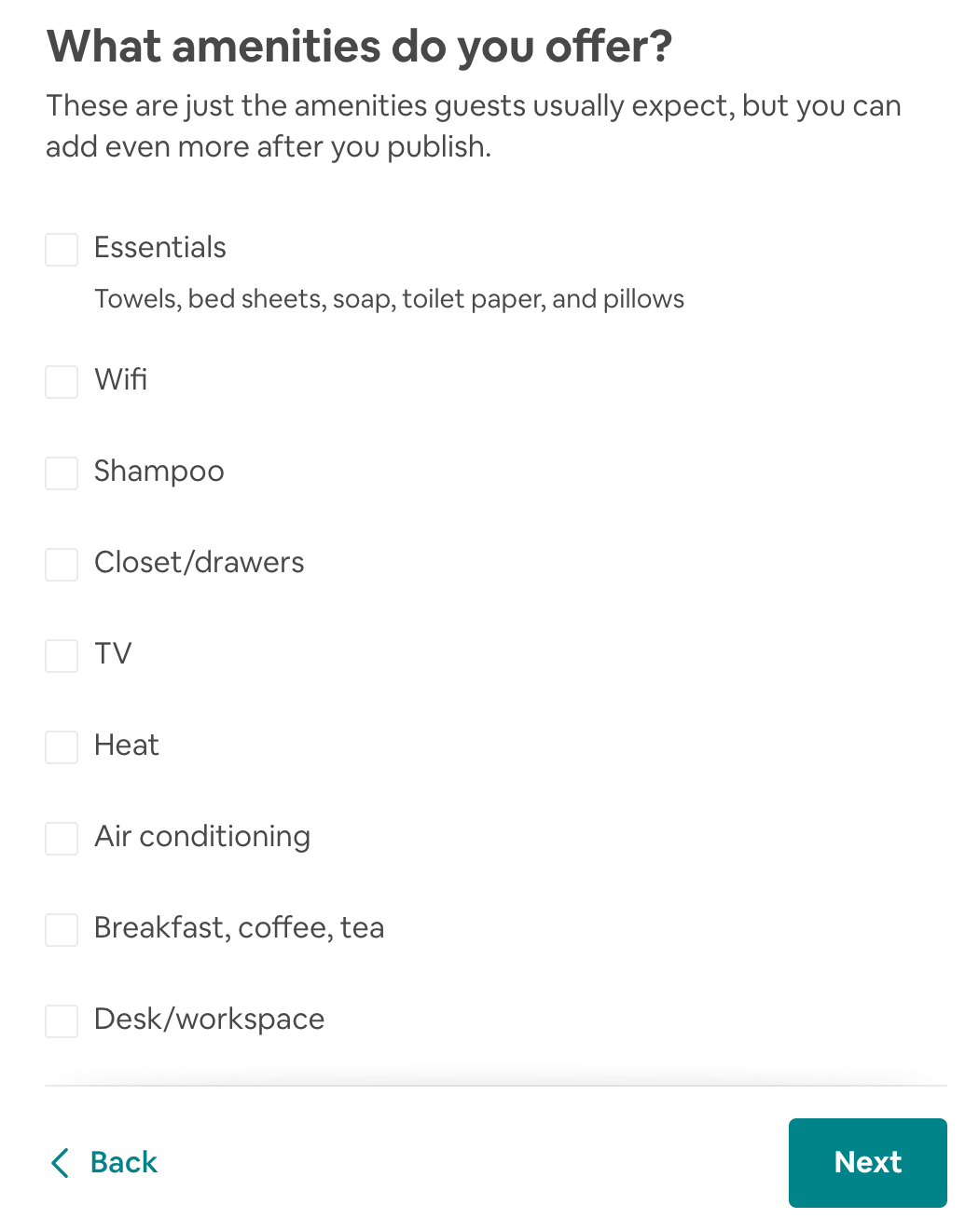

Airbnb Laws Hosts Need to Know in Raleigh NC. Register your Airbnb Business for Taxes. For example you may need a business license a zoning permit or a certificate.

AirBnb collect taxes from your guests and submit to the State so you wont. This is a smart question and we will answer it with a concise analysis. What kind of insurance do I need for Airbnb.

Basic Requirements for Great Hosts. Yes you do need a business licence for AirBnb in the State of Washington and file taxes every quarter. Up to 25 cash back One way to do this is with insurance but beware that renters insurance and homeowners insurance often do not cover short-term or vacation rentals.

In some cases depending on the type of business activity andor the location in which it is being conducted an additional business permit may be required. In certain jurisdictions Hosts of Airbnb Experiences may be required to register their Experiences as a business with the local government andor at the national or federalregional level. Do you need a business license to run an Airbnb.

How to List Your Accommodation. Charlotte requires all people doing business in city borders to obtain a business license. For example we took a look at the requirements to operate an Airbnb business in Seattle Washington where you need four licenses.

3 Pay Your Taxes. Do you need a business license for airbnb. It will soon be necessary for you to have a business license.

Understanding Local Laws and Regulations. The short answer to your question is yes you do. Form your Airbnb Business into a Legal Entity.

An LLC will give you personal liability protection against potential business risks as well as give your company more tax options and credibility. Do I Need A Business License To Run An Airbnb. 2021 brought a big.

Many jurisdictions require owners or operators of certain businesses to. You can apply for a business license in person by post or by email the respective fee depends on the class of business you are seeking to run but costs a minimum of 165. Airbnbs platform was not simply an ancillary or.

In other words you need to find homeowners who. Get a Permit or Obtain a License. The first thing you need to do as an aspiring Airbnb property manager is find clients.

Data from lending company Earnest placed the average monthly income for an Airbnb host at 924. The company estimates average annual earnings for a host to be 7900. If you have questions contact your local government or consult a local lawyer or tax professional.

The license might be called a TOT certificate or a Lodgers Tax License. Ad Save time and receive peace of mind with our business license compliance package. If you are organizing or providing an activity you may need to register obtain a license or follow specific rules.

Plan your Airbnb Business. The State of Hawaiis Department of Taxation DOTax requires all businesses to secure a general excise tax license.

Real Estate Investing Through Airbnb Rental Arbitrage The Beginner S Guide To Earning Sustainable A Passive Income Without Owning Any Property Traditional Buy In 2022 Real Estate Investing Rental Property Real Estate

Hospitality For Short Term Rentals Everything You Need To Know Nestr Short Term Rental Rental Hospitality

Airbnb House Manual Welcome Guide Welcome Book Etsy House Outline Cabin Design Realtor Signs

Starting An Llc For Airbnb Hosts Is It Worth It

Charitabletrave I Will Provide Airbnb Short Term Rental Research For Permit And License For 75 On Fiverr Com Short Term Rental Word Of Mouth How To Plan

New Brunswick Vacation Property Weekly Rental Agreement Form Rental Agreement Templates Vacation Home Rentals Vacation Property

These Are The Best Companies To Work For Employees Say Airbnb Host Airbnb Rentals Airbnb

How To Run An Airbnb Business Everything You Want And Need To Know Youtube Running Need To Know Mens Sunglasses

How To Start Airbnb With No Money Airbtics Airbnb Analytics

Airbnb Requirements What You Need To Become A Host Gigworker Com

Do I Need A Business License To Run An Airbnb Youtube

How To Tell If You Need An Airbnb Business License Airbnb Tips

Pin On Airbnb Social Media Marketing

Starting An Llc For Airbnb Hosts Free Guide Resources

Airbnb Self Check In Instructions 2022 Essential Tips For Hosts Airbnb House Airbnb House Rules Airbnb

Airbnb Welcome Poster Etsy Welcome Poster Wifi Sign House Rules Sign